The NWSL’s Impossible Choice: Fans or Revenue?

28 November 2023

The National Women’s Soccer League (NWSL) just improved the collective annual value of their media rights by over 4,000%.

This isn’t just a game-changing deal, it’s an industry-shaking one.

According to industry sources, the annual value of the deals is US$60 million, just a slight increase on the previous contract of US$1.5 million.

Talk about growth.

Now as you’d expect, this took over our water cooler chat here at HQ. But as we talked, the conversation quickly shifted from cash, to the details of the deal, which left us with a few questions.

What’s most interesting about this deal is the complex nature of it, the NWSL didn’t partner with one or two networks, they signed on the dotted line with four.

This is the lay of the four-deal land:

I need a cup of tea. Or something stronger.

But I will also say the complexity of this deal represents the intricacies of the current US media landscape.

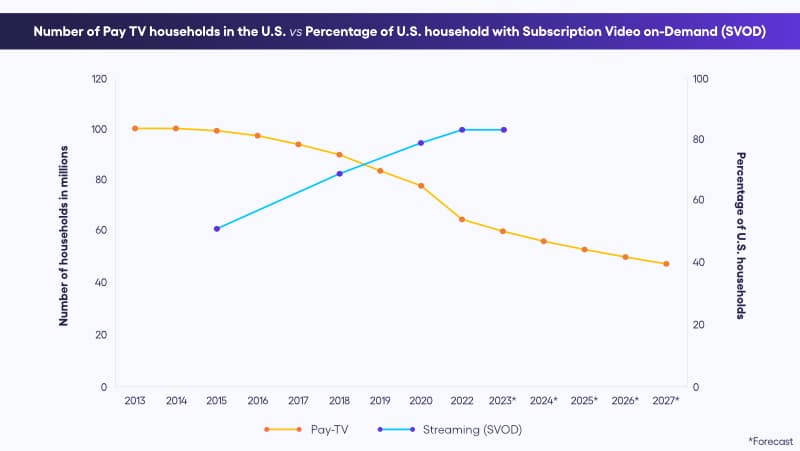

The number of pay-tv households in the US is falling, whilst streaming now accounts for a third of all television viewing.

But what does this mean for fans, and is the NWSL asking too much from its largest, and most important, audience?

With a US$240 million cash boost, NWSL Commissioner Jessica Berman is right when she said, “it’s the beginning of our future”.

More games will be covered than ever before, and funds will go straight into the league, clubs, and players. With two new teams joining in 2024 and high interest off the back of the Women’s World Cup, the deal solidifies their future.

But there’s one thing US fans won’t be overly thrilled about; they now need to sign up to all four services to tune into every game.

We will note that they’ve partnered with two of the biggest US broadcasters in their respective markets; Amazon Prime Video and ESPN, so chances are fans will already have subscriptions.

Amazon Prime Video is currently the most popular subscription video-on-demand service in the US whilst 74 million households have ESPN. But for those who aren’t already subscribed to either, they’ll have to pay up.

Across the pond, the other main professional women’s soccer league, the Women’s Super League (WSL), are about to go to market for their next round of media rights in the new year.

And rumor has it they’re eyeing off a big return after the NWSL’s success.

Here’s their current UK£8 million deal:

Internationally, the WSL holds multiple contracts with different broadcasters.

There’s nothing special here, it’s a stock standard rights deal, but it’ll be interesting to see where this goes when the rights go to market, and whether the FA will adopt a blended model like the NWSL.

The real point of difference in the deals between the two leagues, is how they approach their international audience. While the WSL has numerous contracts for different regions, it has always streamed games on their in-house platform.

It does rub a little salt into the wound when US viewers need to pay to watch games whilst international fans enjoy every game live and free.

There’s been no word on whether this will change going into the next season, but you surely can’t ask your biggest audience to sign up to four platforms whilst the rest of the world watches for free.

Interested in more content like this? Subscribe to our newsletter 👇

Could the NWSL go down an additional DTC route in the future?

More teams and leagues are dabbling into the world of Direct-to-Consumer platforms, the Vegas Golden Knights, Phoenix Suns and Mercury are all streaming games to their local audience. The NBA hosts League Pass, allowing fans all over the world to access every game outside of blackouts for an annual subscription fee.

The NWSL already have their own DTC platform for international viewers, so what’s to say they don’t use it across the US too?

There’s immense value in hosting a DTC platform in conjunction with national broadcasts, and NBA’s League Pass is a perfect example. Local and nationally televised games are blacked out, ensuring a broadcast audience for those partners, whilst every other game is streamed on the platform, meaning every one of the season’s 1,230 games are covered.

If the NWSL adopted a similar model, they would still receive millions in broadcast revenue, whilst capturing valuable first party data to gain an unprecedented understanding of their fans, allowing the league to engage with, and meet the needs of, their supporters on home soil. That data is also incredibly valuable for sponsors too.

The ability to bring in new advertisers is immense, but also owning data in-house is a significant benefit. The move provides unmatched insight into an audience – they’re engaging directly with the brand rather than through a third party. Just imagine all the information you could find out from your global audience compared to the minimal insight networks provide.

And once all that data from the league’s owned platform is centralized, you will have a single view of your customer within a CRM that drives efficiency, revenue and gives your customers an unmatched experience.

Get early access to our upcoming whitepaper 🎟️

Our expert team has made enormous strides over the past few months to seamlessly integrate with leading ticketing platforms, empowering sports organizations to harness the potential of having ticket scan data at their fingertips within minutes.

This will have huge implications for our partners and the data they can collect at speed, so we’re pretty pumped.

More details to come, but if you want to be at the top of the list, we’ll be sharing the latest with our current customers and any other interested parties that want to know more.